Home Equity Loan Guide: Just How to Apply and Certify

Home Equity Loan Guide: Just How to Apply and Certify

Blog Article

Demystifying the Qualification Process for an Equity Lending Authorization

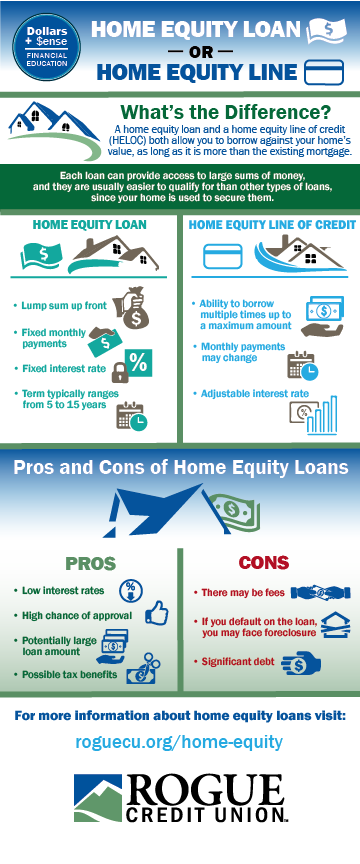

Navigating the credentials process for an equity financing authorization can commonly appear like deciphering a complicated problem, with numerous elements at play that identify one's qualification. Understanding the interplay in between debt-to-income proportions, loan-to-value ratios, and other essential standards is paramount in safeguarding approval for an equity financing.

Secret Qualification Criteria

To certify for an equity financing authorization, conference specific crucial qualification standards is vital. Additionally, lenders examine the applicant's debt-to-income proportion, with a lot of preferring a proportion below 43%.

Furthermore, lending institutions review the loan-to-value proportion, which compares the quantity of the funding to the assessed worth of the property. Commonly, lenders prefer a reduced proportion, such as 80% or much less, to mitigate their danger. Employment and revenue security are vital elements in the approval procedure, with loan providers seeking assurance that the customer has a trusted source of income to pay back the finance. Satisfying these crucial qualification criteria boosts the probability of safeguarding authorization for an equity car loan.

Credit Report Importance

Lenders usually have minimal credit history score needs for equity loans, with ratings above 700 usually thought about great. By preserving a great credit history score with timely expense repayments, low debt usage, and liable borrowing, candidates can enhance their opportunities of equity loan authorization at competitive rates.

Debt-to-Income Proportion Analysis

Offered the important role of credit scores in determining equity funding approval, an additional critical facet that lending institutions evaluate is an applicant's debt-to-income proportion evaluation. A reduced debt-to-income proportion suggests that a borrower has more revenue available to cover their financial obligation payments, making them an extra appealing prospect for an equity car loan.

Lenders normally have specific debt-to-income ratio needs that consumers must satisfy to get approved for an equity funding. While these requirements can vary amongst lending institutions, a typical standard is a debt-to-income ratio of 43% or lower. Debtors with a higher debt-to-income proportion may deal with obstacles in safeguarding authorization for an equity finance, as it suggests a higher risk of skipping on the loan. Equity Loans. It is essential for candidates to assess and possibly reduce their debt-to-income proportion prior to applying for an equity lending to enhance their possibilities of approval.

Home Evaluation Demands

Assessing the worth of the home with a thorough evaluation is an essential action in the equity loan approval procedure. Lenders need a residential property evaluation to make sure that the home provides sufficient collateral for the lending quantity asked for by the borrower. During the residential or commercial property assessment, a qualified evaluator assesses different elements such as the home's condition, size, place, similar building worths in the area, and any special features that may impact its total worth.

The home's evaluation value plays an important role in figuring out the maximum quantity of equity that can be obtained versus the home. Lenders generally need that the assessed value meets or goes beyond a certain percentage of the finance amount, called the loan-to-value proportion. This ratio aids minimize the lending institution's risk by making sure that the property holds enough value to cover the funding in instance of default.

Ultimately, an extensive residential property evaluation is vital for both the loan provider and the debtor to precisely analyze the property's worth and identify the expediency of giving an equity lending. - Equity Loan

Comprehending Loan-to-Value Proportion

The loan-to-value proportion is a key economic metric utilized by loan providers to examine the risk connected with providing an equity lending based on the residential property's appraised value. This proportion is calculated by dividing the amount of the financing by the evaluated value of the residential or commercial property. If a home is assessed at $200,000 and the finance quantity is $150,000, index the loan-to-value ratio would certainly be 75% ($ 150,000/$ 200,000)

Lenders make use of the loan-to-value ratio to establish the degree of danger they are taking on by providing a loan. A greater loan-to-value proportion shows a greater danger for the lender, as the borrower has much less equity in the home. Lenders normally like lower loan-to-value ratios, as they offer a cushion in case the consumer defaults on the funding and the home needs to be offered to recoup the funds.

Consumers can likewise gain from a lower loan-to-value ratio, as it may cause better lending terms, such as reduced rates of interest or decreased charges (Alpine Credits Home Equity Loans). Understanding the loan-to-value ratio is critical for both lenders and customers in the equity loan approval process

Verdict

In conclusion, the credentials process for an equity car loan approval is based on essential qualification requirements, debt rating significance, debt-to-income proportion analysis, residential or commercial property assessment demands, and understanding loan-to-value proportion. Understanding these aspects can aid individuals browse the equity car loan authorization process extra successfully.

Comprehending the interplay between debt-to-income ratios, loan-to-value ratios, and other crucial standards is vital in safeguarding authorization for an equity funding.Given the essential role of credit ratings in identifying equity loan authorization, an additional important facet that lending institutions evaluate is an applicant's debt-to-income ratio analysis - Alpine Credits Home Equity Loans. Consumers with a higher debt-to-income proportion might face challenges in securing approval for an equity loan, as it recommends a higher danger of skipping on the financing. It is essential for candidates to examine and possibly reduce their debt-to-income proportion prior to using for an equity loan to enhance their possibilities of authorization

In verdict, the credentials procedure for an equity financing authorization is based on crucial eligibility criteria, credit score importance, debt-to-income proportion evaluation, property assessment needs, and understanding loan-to-value ratio.

Report this page